Investing in Precious Metals: The Gold-Silver Ratio (GSR)

If you are just getting into precious metals investments, you may hear the terms “gold-silver ratio” or “GSR” or the “Mint Ratio”. These all mean the same thing and they refer to the number of ounces of silver required to purchase an ounce of gold.

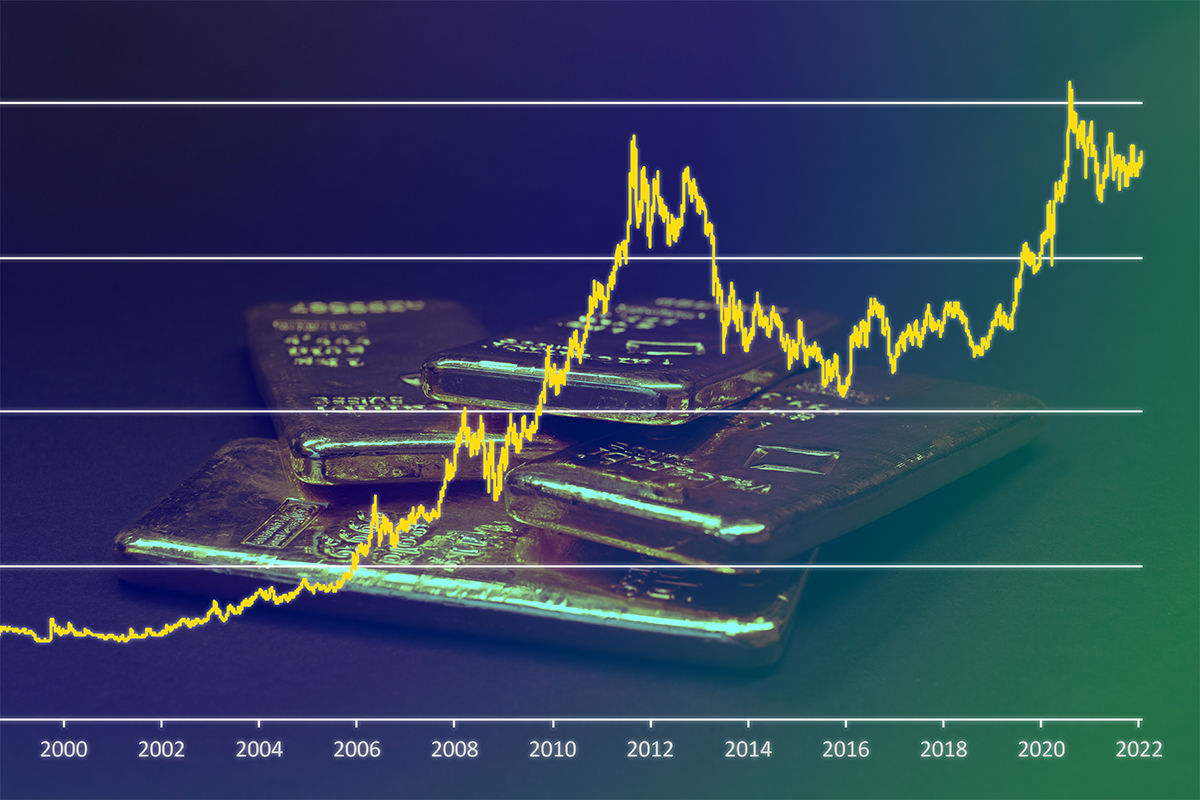

In historic times, many governments set this ratio (and thus the prices of precious metals) to ensure the stability of the precious metals markets as well as their own economies. Since governments stopped doing this, the prices of gold and gold and silver fluctuate daily. One day silver could be down, while gold is up. Since the prices independently change, so does the gold-silver ratio (the number of ounces of silver required to buy one ounce of gold).

It measures similarly to the strength of the global economies, especially the US Dollar Index. This measurement compares the US dollar vs. foreign currencies.

Why Should a Gold or Silver Investor Use the Mint Ratio?

Although the ratio of gold to silver constantly varies, many precious metal investors choose to use this mint ratio to determine when it is a good time to buy silver or gold. There are investors who only buy silver if the ratio reaches a higher number, or only buy gold if the ratio drops to a specific lower number.

Canadian investors do this to have a better understanding when a precious metal is undervalued or overvalued, and thus increase the value of their holdings in the undervalued metal. Using this strategy, the investor accumulates quantities of precious metals, making trades as the ratio swings to highs and lows to increase their holdings.

How Does a Bullion Investor Use the Gold-Silver Ratio Strategy?

Keep an eye on the charts that measure the ratio and see how it works in real time. When the ratio reaches an extreme in your favour, make your purchase and follow the tracking to see how the ratio moves.

When the ratio is a higher number, that means that silver is undervalued compared to gold. And the same is true for lower numbers – that means that gold is undervalued compared to silver. Either scenario means that it could be a great time to buy.

As of this article’s writing, the GSR is around 78. That means it takes 78 ounces of silver to buy a single ounce of gold. This could lead savvy investors to conclude that silver is undervalued compared to gold and it could rise in value in the near future.

Of course the key with this (and any investment, for that matter) is determining when the ratio will reach its peak or valley. Do you buy silver when the ratio hits 80, which many investors consider high, or do you wait until 85?

Whatever you do, trust Royal Bull to help you navigate your precious metals investments here in Canada. If you have questions or comments about the Gold-Silver Ratio or any other matter, reach out to us today.